by Heather T. | May 15, 2025 | Books, Business, Marketing, Observations, Operations, restaurants

Larger Version at the Bottom

Times are tough, that’s nothing new for the restaurant business. I hear that quite a bit from business owners. I don’t want to discount; I don’t want to give away incentives. Margins are thin….etc.

For some businesses I would agree, if it’s what I call a “one and done”. An example might be a hardware store gives away a coupon. The recipient of the coupon waits until they need something to go to the hardware store, they may buy a few things or maybe only one thing that they use the coupon on, and “maybe” have an impulse buy. The hardware store isn’t really getting “more” out of them, other than the customer went to their hardware store, instead of the competitors and they had to lose a little of their profit margin to get them in the door.

Trying to upsell in a hardware store is doable, of course, but all I can think of is a hardware store employee, “Sir, I know you are buying this cordless drill only so you can fix your deck railing, but have you considered this beautiful set of 150 drill bits and perhaps an extra battery as well?”

Restaurants and most other eateries can use discounts and incentives to leverage MORE sales.

If you offer someone a free or deeply discounted appetizer or dessert for example, statistically most diners don’t like to dine alone, there are exceptions of course, but even for single diners, most people won’t go to a place “just” for an appetizer or “just” for the dessert.

If a couple comes in and takes advantage of the free appetizer, it’s not a lot of food (for them) even if they split it, and you still have them in the door to order at least a couple of entrees, possibly another appetizer, maybe some desserts and drinks. Once you have gotten them in the door, that’s also the time to have your staff and management trained to step in and upsell for some additional revenue.

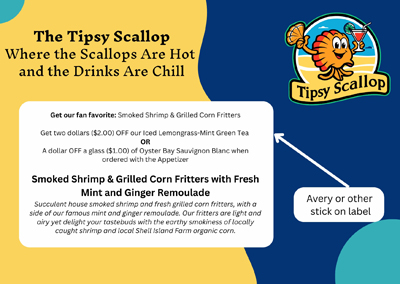

Example: Succulent Smoked Shrimp & Grilled Corn Fritters with Spicy Remoulade.

The manager who is assisting with waiting tables, “Oh, you are ordering the shrimp and corn fritters, I LOVE those, I get those with my girlfriend when we come in on my day off. She swears the Kung Fu Girl Riesling is the BEST with it. I was skeptical because I’m not really a sweeter white fan but the remoulade is a little zippy and it helps balance the spice. She orders it every time we come in and now I’m a big fan!”

Double whammy here for marketing. Yes this example is a little over the top and a little wordy if vocalized, but an example of the upsell, in that the manager says A. he loves the food (he’s a fan) and B. he loves the place so much he will come back on his day off (employee loyalty).

Currently, Kung Fu Girl Riesling runs about $12 retail and less wholesale. Even based on the retail price, if you serve one 5 oz. glass of wine at $5.00 (cheap right?) and the wine is $2.40 your cost per glass, plus tack on a percentage for labor and overhead, you are still making at least a 50% profit margin. And that’s based again on retail pricing.

Even if you upped this to a 6 oz of wine, with wholesale costs, you are still making a hefty profit on this. That’s if you sell it by the glass which is the way to really make money on wine. I worked with an extremely good waiter named Karl many years ago who would use this type of upsell to increase the check average (and his tips). Personal buy-in plus personal endorsement equals sales.

This has always been my personal pet peeve with restaurants, and it’s also a pet peeve of many diners, who refuse to pay for a bottle of wine or by the glass that’s more than double retail prices, and up to four times retail in some places.

Give generous pours at affordable prices and people will order more. Having a great (but inexpensive and unknown) house wine is another way to increase profits, years ago when I was the Chef at a resort in Vermont, I did the wine ordering too, because I liked to do pairings and our front of house manager didn’t know much about wine. The “house” cabernet which was from a small vineyard on the Western Cape of South Africa cost me wholesale $3.50 a bottle. There was no brand name recognition for the wine, so no preconceived thoughts about price, but I had a nice writeup about it on the wine menu so people could get some insight into what kind of wine it was and what it paired well with. We got four pours from the bottle at $4.50 a glass. One dollar profit on one glass ordered (and paid for itself) and 3 additional glasses pure profit minus a small percentage for labor and overhead tacked on, still a hefty money maker.

If you want to make money on full bottles, drop the price to something realistic. Believe me, you will sell a LOT more wine, having done this for years in restaurants. Higher price points mean lower margins when it boils down to it. If you sell 3 bottles a month marked up triple your costs, you will sell less wine.

One of the methods I have used prior is to add on approximately 6 dollars to the average retail price, especially on the name brand recognized affordable wines, to keep the menu price point under $20. You are still making a profit on the $6, including the wholesale discounted price and the labor is the bartender taking 1 minute to open the cork and pour, and a small percentage for general overhead.

You can also add a few dollar corkage fee if you want to bring the “illusion” of costs down even more. $12 of drinkable but inexpensive wine (retail), it’s $16 for the bottle on your menu, plus a $2 corkage fee.

If you train your staff on wine and other beverage pairings and make them able to give suggestions, it not only increases your margins but increases staff knowledge. Pairing wine and beer on the menu itself is also a proven way to increase revenue.

If you or your staff is not well up on wine knowledge, at the moment, ChatGPT can come up with a great list of wines and beers to pair with your menu. I would spot check all of those as in testing as it came up with a couple of “fictional” wines when doing a bunch of testing, but knowing quite a bit about wine and food pairings myself, I’d say it does a more than better-than-average job. Put your menu into ChatGPT or other AI of choice and some specifics, Pair with wines under X dollars and the menu item and any other parameters you want to put in, i.e. Spanish wines only.

Having pairing suggestions on your menu, both alcoholic and non-alcoholic, makes it easy for people to decide and also for those that are afraid or just don’t feel comfortable asking for recommendations.

Tying these into a discount or promotion is carrying it one step further.

Get our fan favorite: Smoked Shrimp & Grilled Corn Fritters and get two dollars off our Iced Lemongrass-Mint Green Tea. Tea is a high profit margin item that costs less than $.50 even with some extra ingredients, selling it at $4.00, even with a dollar off is still a very good “extra” profit item. Most other beverage items, even with a discount, are still money makers.

A few examples, and giving some examples of different ways to describe the menu item as well as the beverage descriptions.

Vegetarian Small Plates + Pairings

Crispy Oven Roasted Artichoke Hearts with Zesty Lime and Rosemary Vegetarian Aioli

For one person: $7.50 For two: $14.50

Pairing Suggestions:

White: Oyster Bay Sauvignon Blanc (NZ)

Aromatic tropical fruits and bright citrus notes, with a refreshingly zesty finish. Recently awarded 90 points by James Suckling.

6 oz. Glass: $5.50 Bottle: $16.50 (Retail average is $10, wholesale would be less).

Red: Georges Duboeuf Beaujolais-Villages

Light-bodied, bright cherry and raspberry fruit, hints of violet and earth. Crisp acidity and low tannins make it food-friendly.

6 oz. Glass: $6.50 Bottle: $19.50

Beer: Bell’s Light Hearted Ale

Light Hearted is aromatic, balanced, and incredibly easy-drinking. This Lo-Cal IPA has only 110 calories, yet all the Heart. Centennial and Galaxy hops result in citrus and pine aromas, while a variety of specialty malts help give Light Hearted its body and flavor.

$4.50

Traditional Cocktails

Gin Gimlet with a Rosemary Twist

Lemon-Basil Vodka Fizz

Non-Alcoholic

House Made Cucumber-Lime Sparkling Water with a Rosemary Sprig

House Made & Herb Shrub

Iced Green Tea with Lemon

Grilled Aji Amarillo Pepper** and Sweet Basil Marinated Halloumi Skewers with Grilled Figs and a Drizzle of Honey Balsamic. **Aji Amarillo Peppers are a spicy South American chili pepper with vibrant orange-yellow skin and fruity flavor. On a scale of spicy peppers from 1-4, Amarillos are about a 3, the Halloumi cheese balances the spiciness of the peppers and brings it down a notch.

Pairing Suggestions:

White: Santo Wines Assyrtiko

Assyrtiko, a Greek white wine, is known for its high acidity and mineral notes. These characteristics complement the salty halloumi and cut through the richness, while the wine’s citrus undertones harmonize with the sweet basil and balance the Aji Amarillo’s heat.

Red: Domaine du Pélican Arbois Poulsard

A light-bodied, naturally bright red from the Jura region of France. It shows delicate red berries, subtle earthiness, and a whisper of spice. Tannins are soft, and the wine finishes with refreshing acidity and a touch of minerality. Earthy undertones match the grilled figs and basil, while the light body complements the dish’s delicate balance of sweet, smoky, and herbal notes.

Beer: Weihenstephaner Hefeweissbier

This German wheat beer offers a smooth, creamy texture with notes of banana and clove. Its subtle sweetness and effervescence provide a refreshing counterpoint to the spicy Aji Amarillo and the savory halloumi, while the beer’s body stands up to the dish’s bold flavors.

Traditional Cocktails

Whiskey Sour

Classic Mojito

Not So Traditional Cocktails

Basil Whiskey Smash

Housemade Honey Balsamic Old Fashioned (balsamic reduction in place of simple syrup with a dash of honey and orange bitter)

Non-Alcoholic

Iced Hibiscus Tea with Orange Peel

Pomegranate Spritzer

Housemade Ginger-Turmeric Tonic (unsweetened)

Smoked Shrimp & Grilled Corn Fritters with Fresh Mint and Ginger Remoulade

Succulent house smoked shrimp and fresh grilled corn fritters, with a side of our famous mint and ginger remoulade. Our fritters are light and airy yet delight your tastebuds with the earthy smokiness of locally caught shrimp and local Shell Island Farm organic corn.

Pairing Suggestions:

White: Dr. Loosen Blue Slate Riesling Kabinett

This Riesling offers bright acidity and subtle sweetness, which balance the smokiness of the shrimp and the heat from the ginger. Its citrus and mineral notes complement the corn fritters and mint in the remoulade.

Red: Cleto Chiarli Lambrusco di Sorbara

Light, fizzy, and dry with red berry flavors (think raspberry and cherry), floral notes, and mouth-cleansing acidity. The slight fizzyness of this red helps balance the richness of the fritters and mild acidity compliments the ginger.

Beer: Saison Dupont

Saison Dupont is a Belgian farmhouse ale known for its effervescence and peppery, citrusy flavors. These flavors cut through the richness of the fritters and enhance the herbal notes of the mint-ginger remoulade.

Traditional Cocktails

Moscow Mule

Daiquiri (Traditional, not frozen)

Not So Traditional Cocktails

Ginger-Lemongrass Rickey

Charred Corn Old Fashioned

Non-Alcoholic

Iced Lemongrass-Mint Green Tea

Shrub Spritz (Ginger-Mint Shrub + Sparkling Wine or Soda)

Savory Tomato-Ginger Tonic

Crispy Polenta with Roasted Beet Bites with Smoked Tomato and Lavender Jam

Pairing Suggestions:

Red: Gnarly Head Pinot Noir

This California Pinot Noir is bold for the varietal, with ripe cherry and raspberry flavors at the forefront. Underneath is a thread of vanilla and toasted oak. Medium-bodied with a silky texture and soft tannins, it finishes with a touch of sweet spice. The wine’s ripe red fruit plays well with the smoked tomato-lavender jam, echoing the jam’s sweetness and contrasting the smoke with bright acidity.

White: Geyser Peak Sauvignon Blanc

A vibrant, zesty white with high-toned aromatics: lime, gooseberry, and freshly cut grass. It’s lean and dry with a bright acidity and a mineral edge, finishing with crisp green apple and citrus zest notes. The wine’s lime and green apple notes offer a clean, tart contrast to the sweetness of the roasted beets and the smoky tomato-lavender jam,

Goose Island Sofie (Saison/Farmhouse Ale)

A Belgian-style saison aged in wine barrels with orange peel. It pours golden with a creamy head. Aromas include white pepper, orange zest, and a hint of vanilla. The taste is tart, citrusy, and subtly spicy, with a champagne-like effervescence and a dry finish. Sofie’s flavors of orange peel and white pepper brighten the earthy sweetness of the roasted beets and contrast nicely with the smoked tomato jam.

Traditional Cocktails

Negroni

Americano

Not So Traditional Cocktails

Lavender-Basil Gimlet

Smoked Tomato Bloody Mary (w/ Lavender Salt Rim)

Non-Alcoholic

Lavender-Lime Soda

Chilled Spiced Carrot Juice

Sparkling Apple-Celery Tonic

A marketing piece like this can be used for mailers, in house promotions (put it on a tent card or menu holder) encourages guests to buy prior to ordering while dining, and as social media posts. “Mention this ad and get…..”

This is a sample chapter for my upcoming book on Guerilla Marketing, releasing mid-summer 2025. The book will be focusing on over 100 Guerilla Marketing ideas with examples, as well as a few chapters like the above. I have a favor to ask, if you catch a typo please send me a wave and let me know, snarky comments are appreciated if they are well meant and funny, even running text through two very good grammar editors doesn’t always catch things and my book editor has not yet had a crack at this. 🙂

by Heather T. | May 7, 2025 | Blog, Books, Business Location

This is Chapter Eleven from my book, Location? Location! Finding a Location for Your Brick and Mortar Business. How to Scout the Perfect Location for Your Dream of Opening a Brick and Mortar Business.

This is Chapter Eleven from my book, Location? Location! Finding a Location for Your Brick and Mortar Business. How to Scout the Perfect Location for Your Dream of Opening a Brick and Mortar Business.

Lot Conditions can factor heavily into additional costs, and also inconvenience for an owner buying a new building or property plot if not considered prior to purchase and typically buyers don’t give a lot of thought to a parking lot unless it’s in very bad shape to start with.

Does the property you have found have a parking lot? Is it just for your business, or is it shared with an adjacent business? What is its condition? Paved? Gravel? Dirt? Something else?

If you are buying a location, is the parking lot going to need work? How much is it going to cost to repave or regrade? Does the lot slope towards your building? Or away? If it’s a gravel or dirt parking lot, how much and how often will it need fill or leveling?

Are you in an area with a lot of rain that may affect your lot’s condition? Or is it at the bottom of a hill or mountain that may have an excessive amount of melting snow/runoff in the spring?

When I worked in Vermont during the spring, the parking lots at the Ski Resort I worked at would frequently get flooded. The resort was open for business year-round and we would get some extremely grumpy customers complaining about navigating partially flooded parking lots.

If you are leasing the property, does the landlord have a history of maintaining the lot? If it needs maintenance to bring it up to acceptable use levels, is the landlord going to pay for that? And who defines “acceptable?” Make sure you get a written agreement from the landlord, and before signing anything, have a good business lawyer look over that agreement.

Why should you care about the condition of the parking area? A business with a well-maintained level of paved surface will look much more attractive to a passerby than a lot filled with enormous cracks, missing chunks of pavement, and grass tufts scattered throughout it.

Even more critical than curb appeal, the condition of the lot can impact a car driving through it (think potholes) and the walk from your lot to your business are important factors in the safety and well-being of your customers, as well as their vehicles.

If you don’t have parking on site and only street parking, paid lots, or a parking garage parking nearby, what shape are they in? Paid lots can discourage visitors if they are not in very good shape, as can parking garages. If your customers or staff are leaving late in the evening or arriving early in the morning, how safe are these locations? Are they well lit? Guarded? These factors all play into how comfortable people will be patronizing your brick and mortar business.

What are roads like locally? Are they well maintained? What condition are they in after a long winter? Are there lots of frost heaves that the town doesn’t pay attention to or massive potholes that it seems to take forever for the town or city to repair? Do the plows do a good job? And are they timely about getting out and clearing passage in regular snowstorms?

You won’t know if you are looking at the property in the spring, summer or fall, but this is where talking to residents and local businesses can help you fill in those holes in your knowledge base.

Consideration points for this chapter.

If there is a parking lot:

How many spaces do you have for the facility?

How many ADA/handicapped spaces do you have?

Are they well marked on the pavement, and via signage?

What condition is the parking lot in?

Is there also going to be enough parking for your employees?

Yes No

If No, where are they going to park?

How much is plowing going to cost in a bad winter? Don’t take average costs per winter. Base your budget on the worst winter you can get information on.

What other maintenance and repair needs are required for the lot?

What kind of shape is the lot in? Does it need a redesign and/or need work soon? If so, budget for it now.

Are there spaces set aside for pickup/delivery only? (if applicable)

Yes No

And if not, is there room to set aside and designate a few spaces for them?

Yes No

How is the lot laid out? Is the traffic flow with-in the lot easy to navigate or will people with oversized vehicles have trouble navigating the lot or pulling into or out of spaces?

Are there spaces for motorcycle parking? And if not, is there room to set aside or designate a few spaces for them? If you potentially have customers that may come in on bikes, you may want to consider this.

Yes No

Notes:

by Heather T. | Apr 28, 2025 | Business, Marketing, Observations, Operations, Social Media

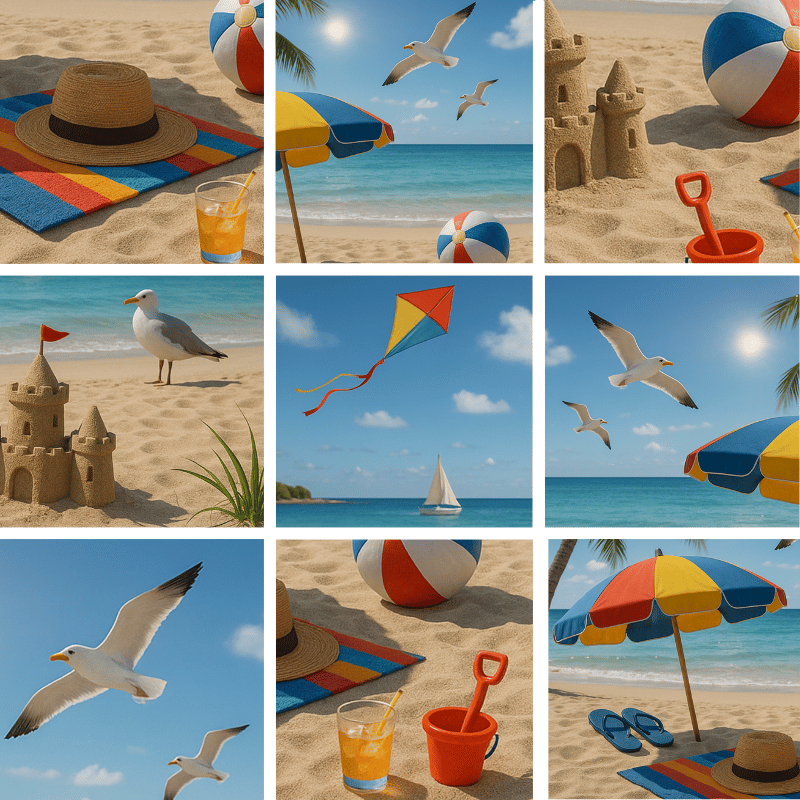

A common complaint I get from clients, both personal, and business mentoring clients, is that they rarely have enough time to take lots of photos for marketing use. Here is an easy solution if you are running into that problem.

You can break most photos into at least three or four separate photos, and often many more, depending on the number of elements and objects. With the excellent photo capability of many of today’s cell phone cameras, clear auto-focused high resolution photos are very easy to get.

This is a simple thing you can do using your cell phone (or other source) photos and Canva.com. If you don’t have a Canva account yet, just start with the free version and many times for both personal and business use, that may be all you end up needing.

Step One is to create a base size for your image. It could be inches or pixels. It can be square, rectangular, vertical or horizontal. Use the image size and image format to best suit whatever project, whether it be digital marketing or print that you might need it for.

Step Two is to upload your photo (or other image, could be a graphic) to Canva.

Step Three is to insert your photo into your created image size.

Step Four is resize, zoom in, zoom out, move around the screen or flip.

Step Five is to see how many additional images you can create with one photo or graphic.

Here are a couple of examples of using one image and creating multiple images from one. I’m a big believer in keeping it easy peasy and this helps save time and extend any images you might have for marketing while keeping costs down. And these are AI generated purely to use for examples.

by Heather T. | Mar 11, 2025 | Business, Business Location, Observations, Operations

In Chapter 13 of my location assessment book I talk about foot traffic. I’d like to dive in a little bit more on foot traffic and using hair salons is a perfect example of this. If you are in a more rural area, your traffic is primarily going to be dependent on people making appointments and driving anywhere from a short distance to a long distance away rather than foot traffic. In this case how (website, social media, print ads, online ads, networking, etc.) and where you advertise (where is the competition advertising?) as well as making sure your pricing is in line with area competitors is going to be key.

If you are in a more urban area and even more densely populated one like New York City you’re going to have different types of foot traffic. I am going to include some types of public transportation as foot traffic because unless you have a subway or bus stop right in front of your salon, there is still typically some walking. There are walkers that are passersby, typically a very small percentage that are going to be impulse walk-ins, although a barber shop may have a higher percentage, and clients who walk from their homes or businesses.

For example, you might have someone that lives within two to five blocks of your salon walk to it, or they might take a bus, subway or elevated train depending on where you are. Your clients with a more disposable income might be coming from a similar distance away but they may prefer to take a cab or have a driver drive them.

Your clientele might be primarily men, or primarily women or could be a mix, or families. Are they clients that are looking for a quick serve in and out for a 20 minute wash, cut and blow dry, or is it a two hour experience? Is your clientele single professional people with more money to spend on an appointment? Are you close to residential neighborhoods and if you are, what types of neighborhoods are they? Are you more in the heart of a financial, business or shopping district? And again, who are the types of people that might come and either work in the area or shop in the area? How much time do they have on their hands and importantly when? Lunchtime? Prior to work? After work? It might be a combination of some or all of those, but it’s important to think about how they will come to you if you’re in a city or more urban area that may not have a lot of parking or limited parking.

Doing this assessment preopening a location can help dictate what hours you are going to be open and what you offer. If you are catering specifically to families with kids, with kids in addition to parents being clientele, evenings and weekends will typically be busier except during school breaks and the summer months, so plan accordingly.

What services do you think they’re willing to pay for, as well as what are the competitors offering, plus what are the competitors charging? And I say “think” for a reason. Do your research first, ask questions of residents and do the competition stalking because if you just assume that moving into a salon that offers services to a demographic that doesn’t want, can’t pay for, or does not have time to take advantage of, turns the word assume into any of your choice of applicable acronyms.

- Avoiding Serious Study Undermines Market Entry

- A Strategy Sorely Underestimated Means Exit

- Analysis Shortcuts Sink Unprepared Market Entrants

- A Stupid Strategy Usually Means Exit

- A Startup Stumbles Unless Market Examined

- Avoiding Smart Steps Undermines Money & Effort

- A Strategy Sans Understanding Means Exiting

- Avoiding Study Secures Unnecessary Mistakes & Errors

Three additional things to think about when opening a salon, whether you are building from scratch, revamping an existing space (occupied formerly by another type of business) or taking over an open (or recently closed but existing salon).

Just because an existing salon has been operating in the space doesn’t mean you don’t still need to evaluate these things. If a space offers four salon chairs and you plan to add two additional chairs into the space, you will need to find out whether you will have the plumbing capacity to handle additional high-water usage and have proper drainage. A new or renovated space needs to have sufficient plumbing to handle multiple shampoo stations. Most standard retail spaces often lack the proper pipe capacity, hot water heating capability and may have potential drainage issues.

Another consideration is ensuring the space has proper ventilation for the strong chemicals and styling sprays used commonly by salons. Having sufficient HVAC capacity is critical to prevent fumes from building up.

The third consideration is that the electrical system must be able to support multiple high-wattage appliances running simultaneously. I spoke with a business owner last year who renovated an existing space that was formerly a retail store (not a existing salon), and had to spend over 25K to upgrade the current electrical system between upgrading the existing electrical panel, new wiring and dedicated circuits and labor costs. So it’s worth evaluating (and getting several cost estimates) if you are renovating or expanding a place you are renting or planning on purchasing beforehand.

Action items:

Who is the competition?

What is their pricing?

What do they offer?

Where and how do they advertise? (Offline and Online)

Can the area of region support another salon/hair stylist? Or is there already market saturation?

Who (specifically is your target market(s)?

What services are they looking for? (don’t assume: ask, research, poll, do surveys)

Does the location have adequate water and drainage?

Is there adequate HVAC needs for the space?

Is there adequate electrical capability for the space?

For additional touchpoints and topics on evaluating a space for your salon, please check out Finding a Location for Your Brick and Mortar Business

by Heather T. | Mar 6, 2025 | Blog, Business, Observations, Operations

Times are tough right now for many businesses. When they say, “May you live in interesting times”. It’s unfortunately not a blessing of future wellbeing. I know many businesses, no matter who you voted for, are feeling the pinch of not being able to find staff, costs rising on things outside of anyone’s control, like a bad coffee bean harvest, for example, and other challenges.

Times are tough right now for many businesses. When they say, “May you live in interesting times”. It’s unfortunately not a blessing of future wellbeing. I know many businesses, no matter who you voted for, are feeling the pinch of not being able to find staff, costs rising on things outside of anyone’s control, like a bad coffee bean harvest, for example, and other challenges.

As a small business owner myself, I try to give back to the community as much as I can, but it seems like sometimes it’s just not enough, and I’ve talked to many other business owners who have felt and feel similar.

None of these suggestions are anything new or earth shaking, but I thought it might be helpful to condense some ways a business owner might further contribute to their local communities if you feel like there are things going on that you have no control over and feeling “stuck” or unmotivated. And maybe you need to do “more”.

Taking part or getting involved more on a local level is something as small businesses IMO we should do anyway, but sometimes we don’t have the time, the motivation, or the incentive. These cost little to no money and can bring back to a business marketing and branding exposure, plus the knowledge that you are contributing to your local community, and sometimes that comes back to you in spades in terms of knowing you helped others. As a small business mentor, it’s one of the most rewarding things I have ever done in my life and it helps keep me going.

- Use social media, emails, or posters to share local help like food banks or mental health services.

- Give advice related to your field, like job tips or budgeting help (or other expertise).

- Be a volunteer small business mentor. SCORE.org, MicroMentor, CWE

- Volunteer in the community. Habitat for Humanity, Red Cross etc.

- Promote other small businesses and non-profits in your area.

- Let local artists or service providers use your space.

- Host free classes or networking events.

- Offer a quiet space with Wi-Fi for students or remote workers.

- Set up a donation box for food, clothes, or supplies.

- Set aside a portion of new income to donate to food pantries or for people with food insecurities or other needs.

- Organize volunteer events for employees and customers.

- Offer “pay-what-you-can” pricing for key items or services.

- Allow flexible payment plans for struggling customers.

- Recognize local heroes like teachers and healthcare workers.

- Plan small community events, in person and online.

- Give free resume reviews or career coaching.

- Connect job seekers with opportunities through your network.

- Provide free consultations in your area of expertise.

- Teach free or low cost classes on business, budgeting, or job skills (or other expertise).

- Let nonprofits or local groups use your space for free.

- Set up a bulletin board for local resources.

- Allow customers to prepay for items or services for those in need.

- Offer small rewards for donating to local causes.

- Use social media to highlight fundraisers and community needs.

- Share inspiring local stories to boost morale.

- Offer internships or job training for students.

- Sponsor school programs or small scholarships.

- Give workers paid time to volunteer.

- Match donations employees make to charities.

- Donate leftover goods instead of throwing them away.

- Reward customers who recycle or support sustainability.

- Offer stress-relief activities like mindfulness or support groups.

- Share resources for mental health support.

- Partner with local nonprofits.

- Create a neighborhood help board or digital forum.

- Start a community garden in unused spaces.

- Host/teach free cooking classes for those with food insecurities or ones that need help with nutrition and meal planning.

- Start a POD (Print on Demand Business) and donate a good portion of profits to local non-profits, food banks/charities etc. POD businesses are free or low cost to start up.

- Volunteer to be on a local non-profit board of directors.

by Heather T. | Feb 17, 2025 | Business, Observations, Operations, Selling a Business

Additional information on each question from 50 Questions to Ask a Business Broker When Selling a Business

Additional information on each question from 50 Questions to Ask a Business Broker When Selling a Business

Q26. How do you manage negotiations with buyers?

Why should you ask this?

A broker’s negotiation skills are important to boosting your business’s worth. Sales success and timing depend heavily on their talent for productive discussions. Finding out how they deal with offers and counter-offers, and whether they’re usually the ones to make the first move, or prefer to respond to others, can help give some insight on how they address negotiations.

It’s important to have a broker who can effectively negotiate on your behalf, to get the best price and terms for your business sale. Finding out how they approach negotiations and manage buyer expectations for the business helps to make sure that your interests are being served in the best way possible.

Sales negotiation isn’t just about price, it also involves payment structures (cash vs seller financing), non-compete agreements, or other clauses. Asking for examples of how they’ve handled past negotiations and resolved any conflicts can give you a better sense of their approach and effectiveness. Look for a broker who can advocate for your best interests while ensuring the deal progresses. They should understand the buyer’s interests as well and structure the deal to serve both parties as much as possible.

Q27. What are your commission rates and fee structure?

Why should you ask this?

To determine your expenses, you must know the broker’s commission rate and fee structure. A commission-only system is used by many brokers. Broker commissions are typically 5–10% of the final sale price, however, this percentage is subject to change. I have also seen commission rates range up to 12% and sometimes more, depending on elements such as the size and complexity of the transaction. While more complex sales may involve higher rates, typically rates usually do cap around 10-12% for very small businesses. It’s important to clarify the fee structure right upfront, so you don’t get caught by surprise later on.

Some brokers use a tiered commission structure, where the percentage decreases as the sale price increases. Knowing these details right off the bat helps you understand the total cost of the broker’s services and ensures the rates align with your expectations. Some brokers ask for money upfront, since they’re not certain they can sell your business, but others only charge if they sell it, as they’re very selective about which businesses they work with. Brokers who charge primarily success fees may have an incentive structure better aligned with the seller’s interests.

Q28. Are there any upfront fees?

Why should you ask this?

Upfront service fees may apply with some brokers. You should clarify if the fees are included in the final commission to plan your budget effectively. Ask if the broker expects a retainer or upfront payment to work with you. Other upfront fees may pay for services such as formal business valuations or marketing materials like confidential information memorandums and teaser documents.

Make sure to ask the broker if they require any initial payments or retainers, and whether those are refundable. Understanding these fees in advance will help you know how much you’ll need to invest upfront before the sale is confirmed. You can also ask the broker whether they will credit this retainer toward the commission if the sale closes successfully. Clarifying these details upfront ensures you know the full scope of financial commitments before proceeding with the sale.

Q29. Do you charge a minimum fee if the sale price is lower than expected?

Why should you ask this?

You need to clarify whether the broker charges a minimum fee if your business sells for less than expected. This helps you avoid unexpected financial surprises.

Some brokers have a minimum fee that applies regardless of the final sale price. This can affect your net proceeds, particularly if market conditions lead to a lower-than-expected sale. For example, a broker may charge a 10% commission but have a minimum fee of $20,000. This means if the sale price falls below $200,000, you would still owe the broker $20,000.

Q30. How is the commission calculated (e.g., a percentage of the sale price)?

Why should you ask this?

It’s important to understand how the broker calculates the commission to accurately estimate your net proceeds after the sale is finished.

Brokers commonly determine their commission based on a percentage of the gross sale price, this includes all assets sold (real estate, equipment, and intellectual property etc.). The commission structure might vary depending on factors like the deal’s structure (e.g., cash, stock, or earn-outs).

If the sale involves contingencies like earn-outs, clarify in detail how the broker’s commission applies to future payments. Some brokers may charge their full commission upfront based on the total sale price, while others may tie their commission to each payment made as part of the earn-out.

by Heather T. | Jan 30, 2025 | Business, Observations, Operations, Selling a Business

Additional information on each question from 50 Questions to Ask a Business Broker When Selling a Business

Additional information on each question from 50 Questions to Ask a Business Broker When Selling a Business

Q21. How do you ensure the confidentiality of sensitive business information?

Why should you ask this?

This is critical to safeguarding your private business details.

Selling a business is a sensitive matter. If word gets out that your business is for sale, it can create uncertainty among employees, customers, and suppliers, which may disrupt operations or reduce the value of the business. A broker must take steps to ensure confidentiality.

Brokers typically use non-disclosure agreements (NDAs) and limit the amount of information disclosed at the outset. They may also use “blind ads”—advertisements that describe the business without revealing its identity—to attract buyers while maintaining confidentiality. Ask the broker how they screen potential buyers before sharing sensitive information, such as requiring proof of financial stability or serious intent. A reliable broker will have strong confidentiality measures in place to protect your business’s identity while marketing it to qualified buyers.

Q22. What steps do you take to protect the identities of buyers and sellers?

Why should you ask this?

Brokers must take strong measures to protect the identities of both buyers and sellers throughout the sales process. Confidentiality is crucial during a business sale for both buyers and sellers. For sellers, revealing that the business is for sale can create uncertainty among employees, customers, competitors, or suppliers, potentially disrupting operations and reducing the business’s value. Companies buying other businesses, especially competitors, should keep their identity secret to avoid losing their advantage or harming other transactions.

Q23. How do you maintain confidentiality during the marketing and sale process?

Why should you ask this?

Confidentiality is crucial when selling a business, as a premature disclosure that the business is for sale can lead to significant risks, such as losing key employees, damaging relationships with customers and suppliers, or giving competitors an edge. Discretion is essential in preserving the business’s operations and value throughout the sale process.

Brokers typically use a combination of legal agreements, marketing strategies, and information management techniques to safeguard confidentiality.

Here are the key measures brokers take to ensure that both the seller’s and buyer’s identities and sensitive information are kept secure throughout the sale process:

1. Non-Disclosure Agreements (NDAs)

Before any confidential information is shared with potential buyers, brokers require them to sign a Non-Disclosure Agreement (NDA), a legally binding contract that obligates buyers to keep any business information they receive confidential and not use it for competitive purposes.

NDAs are the primary legal tool to protect confidentiality, ensuring that sensitive information (e.g., financials, customer lists, intellectual property) is not disclosed to third parties or misused. This also creates legal recourse if a buyer violates the agreement.

The broker will only release detailed information about the business (such as a financial summary or detailed operational data) to potential buyers who have signed an NDA. Additionally, NDAs often stipulate that buyers cannot contact the seller’s employees, customers, or suppliers without permission, further protecting the business.

2. Blind Listings (Teaser Documents)

Brokers often use “blind listings” or “teaser documents” in the early stages of marketing. These documents provide high-level details about the business—such as its industry, general location, and revenue range—without disclosing the name or any identifying characteristics of the business.

This tactic allows brokers to attract serious buyers without revealing the identity of the business too early. By keeping specific details anonymous, the broker can gauge buyer interest while minimizing the risk of competitors or other parties learning about the sale.

Blind listings typically include information like “a profitable manufacturing business in the Midwest with $5 million in annual revenue” rather than naming the specific company or location. This protects the seller’s identity while still providing enough detail to generate interest from prospective buyers.

3. Controlled Release of Information (Staged Disclosure)

Brokers control the flow of sensitive information, releasing details incrementally as the buyer progresses through the stages of interest and qualification. Only qualified and serious buyers who have signed NDAs, are given access to more detailed information.

Staged disclosure provides sensitive information only to buyers demonstrating financial capacity and genuine interest, thus minimizing the risk of competitors or non-serious buyers accessing valuable business data.

The broker may initially provide potential buyers with a high-level teaser document or a blind listing. If a buyer expresses interest and signs an NDA, they may then receive a more detailed information memorandum (IM) that includes financials, operational details, and business history. The most sensitive information, such as customer lists or specific pricing strategies, is often withheld until due diligence or after a Letter of Intent (LOI) is signed.

4. Buyer Screening and Qualification

Before sharing detailed information about the business, brokers carefully screen potential buyers to ensure they are financially qualified and genuinely interested in purchasing the business.

Screening buyers helps to prevent time-wasters, competitors, or those with no financial capacity from accessing confidential information. This process also ensures that only serious, qualified buyers reach the stages where sensitive business data is disclosed.

Brokers may ask buyers to provide proof of funds, a buyer profile, or details about their acquisition goals before moving forward. By verifying that a buyer has the financial capacity and intention to purchase, the broker can protect the business from unnecessary exposure to unqualified parties or competitors.

5. Anonymous Communication and Initial Negotiation

In some cases, brokers will facilitate early communications between buyers and sellers without revealing the identity of the business or the seller until the buyer has progressed through the screening process.

Keeping the seller’s identity anonymous during initial negotiations prevents sensitive information from leaking to the broader market, competitors, or stakeholders. This is important when selling a business in a competitive industry, where revealing that the business is for sale could weaken its market position.

During the early stages of negotiation, the broker may act as the intermediary for all communications. The buyer might submit questions or initial offers through the broker without directly contacting the seller. The broker will gradually facilitate introductions as the process moves forward, and the buyer shows serious intent.

6. Use of Secure Data Rooms

A secure online data room is a digital repository where confidential documents and information about the business are stored. Brokers often use these platforms during due diligence to give buyers controlled access to sensitive information.

A secure data room allows for the controlled and monitored sharing of sensitive documents. The broker can restrict access to only certain documents based on the stage of the sale process and monitor who views the information, reducing the risk of data leaks.

Upon signing an NDA and showing serious interest, typically then a buyer receives access to the secure data room. The broker can track who has viewed the documents and limit downloads or printing to protect the confidentiality of the materials. This approach also allows the broker to revoke access if necessary, providing additional control over sensitive information.

7. Masked Financials and Redacted Information

Sometimes, brokers may provide financial statements or key business documents with certain details masked or redacted to maintain confidentiality while still providing necessary data to potential buyers.

Masking or redacting sensitive information ensures that buyers receive the financial data they need to assess the business’s value without gaining access to information that could compromise the seller’s position if the deal doesn’t close.

For example, the broker may provide financial statements that show overall revenue, profitability, and expenses but omit specific customer names or contract details. This allows the buyer to assess the business’s performance without having access to proprietary information that could harm the business if exposed prematurely.

8. Timing of Stakeholder Notifications

Brokers may advise sellers to wait to notify certain stakeholders, such as employees, suppliers, or customers, until after key milestones (such as signing an LOI or closing the deal) are reached.

Premature disclosure of a potential sale to employees or suppliers can cause disruptions in the business, such as staff departures or renegotiation of supplier contracts. Timing the notification of key stakeholders helps maintain business continuity and protects the business’s value.

The broker works with the seller to determine the right time to inform employees, suppliers, and customers about the sale. In many cases, sellers wait until after an LOI is signed or the due diligence process has begun to ensure that the buyer is serious and that the sale is likely to proceed.

9. Ensuring Buyer Anonymity

Just as sellers need confidentiality, some buyers, especially strategic acquirers or competitors, may also require their identities to remain confidential until the final stages of the sale.

Buyers, particularly those engaged in strategic acquisitions, may not want competitors or other market players to know about their acquisition plans. Disclosing the buyer’s identity too early can lead to competitive disadvantages or complicate other deals they are working on.

Brokers can maintain buyer anonymity by having initial discussions without revealing the buyer’s name. For instance, a strategic buyer might be referred to as “a regional player in the “X” industry” during early negotiations, with their identity only being revealed once the deal is further along.

Q24. What is the typical timeline for selling a business like mine?

Why should you ask this?

The timeline for selling a business can vary depending on factors such as the size of the business, the industry, and market conditions. However, a skilled broker should be able to provide a rough estimate, typically ranging from a few months to over a year. The process usually begins with preparing the business for sale, which can take a few weeks to several months.

This phase includes gathering financial documents, updating operational systems, and ensuring that all necessary paperwork is in order. After listing the business, finding a suitable buyer typically takes three to six months, although market demand can lengthen this period or shorten in some cases. After a buyer is found, the due diligence and negotiation phase can add another 1 to 3 months, followed by the final closing, which may take an additional few weeks to complete.

It’s important to recognize that certain factors can affect this timeline. For instance, if there are complicating factors such as real estate involved, or if the buyer is looking for specific assets or has unique terms, it may extend the process. The speed at which you and the broker can respond to offers, requests for additional information, and other deal elements will also affect the overall timeline. Working with a broker who is proactive and well-connected can sometimes shorten the process, but patience is key, as a thorough due diligence process is crucial for a successful sale.

Q25. What are the key milestones in the sales process and how do you handle each stage?

Why should you ask this?

Understanding the key milestones in the sales process—such as valuation, marketing, negotiations, and due diligence—along with how your broker manages each one, helps you know what to expect and the level of involvement required from you. Knowing these stages in advance ensures you’re prepared for each step of the process and that you’re aligned with your broker’s approach.

The sale of a business involves several critical milestones that need careful attention and coordination. Being aware of these steps helps you stay informed and engaged throughout the journey, minimizing surprises and setting realistic expectations.

Typical milestones include:

- Initial Business Valuation: The broker evaluates your business to determine its market value.

- Preparation of Your Marketing Materials: The broker creates key documents like teasers, confidential information memorandums, and financial summaries to attract potential buyers.

- Online and Offline Marketing: Your broker markets your business to qualified buyers using various channels and strategies.

- Receiving and Evaluating Offers: Offers come in, and the broker helps you assess their viability and terms.

- Negotiation: Your broker negotiates terms with the buyer to secure the best deal possible.

- Due Diligence: The buyer thoroughly reviews your business’s finances, operations, and legal standing to ensure the accuracy of the information provided.

- Finalizing the Sale: The purchase agreement is negotiated, and the sale is officially closed.

A good broker should clearly explain how they handle each of these stages, the level of communication you’ll have, and what role you will play throughout the process. For instance, ask about their approach to managing negotiations and due diligence, as these can often be the most intricate and time-consuming stages.

This is Chapter Eleven from my book,

This is Chapter Eleven from my book,

Times are tough right now for many businesses. When they say, “May you live in interesting times”. It’s unfortunately not a blessing of future wellbeing. I know many businesses, no matter who you voted for, are feeling the pinch of not being able to find staff, costs rising on things outside of anyone’s control, like a bad coffee bean harvest, for example, and other challenges.

Times are tough right now for many businesses. When they say, “May you live in interesting times”. It’s unfortunately not a blessing of future wellbeing. I know many businesses, no matter who you voted for, are feeling the pinch of not being able to find staff, costs rising on things outside of anyone’s control, like a bad coffee bean harvest, for example, and other challenges. Additional information on each question from

Additional information on each question from  Additional information on each question from

Additional information on each question from